If we look around us, it’s hard to find a product that doesn’t have chemicals in it. Chemicals are used in many sectors, including health, energy, mobility and housing. This extensive use might reflect their importance in ensuring the high living standards of our modern society.

Europe has an important role in this respect. After China, the Union is the second largest chemical producer in the world in 2021 with the EU27 chemical sales increasing to 594 billion euros and employing over 1.2 million people directly. In addition, the industry supports 3.6 million jobs indirectly and contributes to more than 10 per cent of the EU27 manufacturing employment.

Despite their widespread use, the chemical industry, as a whole, can be characterised by a duality. On the one hand, chemicals participate in satisfying modern needs and several of them are known for their capacity to add a significant contribution to the green and digital transition. On the other hand, the chemical and petrochemical sector together makes one of the most energy-intensive industries.

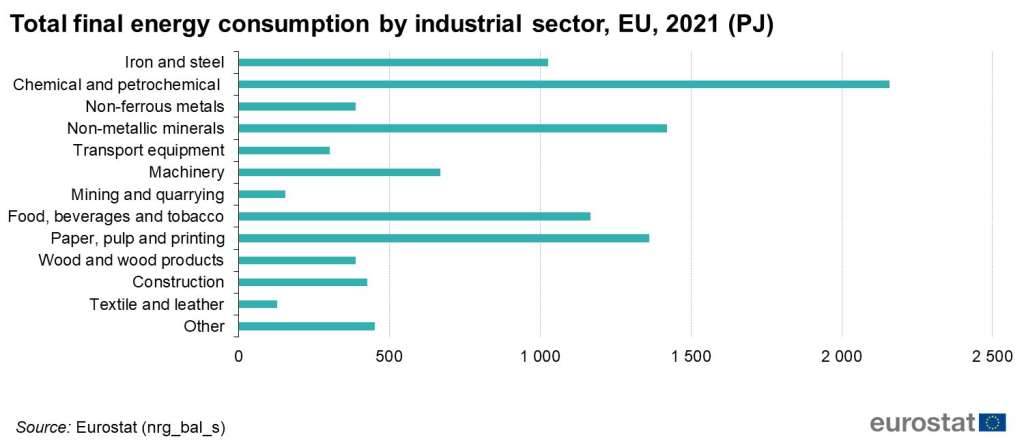

Based on recent data from 2020, this industry accounts for 22 per cent of the total final energy consumption within the EU, with a major part of the energy need being supplied by natural gas. Another concern is the pollution that certain chemicals create and their hazardous properties including risks to health and the environment. The chemical industry is the third emitter of carbon dioxide (CO2) emissions in the EU (925 millionth tonnes of CO2 in 2021), behind only the cement and iron and steel industries.

The EU has already laws in place such as the regulation on the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) to restrict the use of hazardous chemicals. Reducing the use of hazardous chemicals and making the industry more sustainable is particularly important as global chemical production is expected to double by 2030.

Regarding REACH, one of its main objectives is to ensure that the most dangerous substances are replaced by less dangerous ones. Based on a recent report by the European Chemicals Agency (ECHA), the 59 substances of very high concern subject to authorisation under REACH and placed on the EU market decreased by 45 per cent in the EU between 2010 and 2021.

Earlier in May, the Commission launched an open public consultation as part of an initiative to prohibit the production for export of hazardous chemicals that are banned in the EU, within the Chemicals strategy for sustainability launched in 2020. The objective is to promote safety and sustainability standards outside the EU, to further align the EU’s internal and external policies and lead by example.

“Chemicals can be very useful for our society and economy, but we must produce and use them without causing harm to people and the planet,” commented the Commissioner for Environment, Oceans, and Fisheries, Virginijus Sinkevičius. “The EU would not be consistent in its ambition for a toxic-free environment if hazardous chemicals that are not allowed for use in the EU can still be produced here and then exported. These chemicals can cause the same harm to health and the environment regardless of where they are being used. As various Member States start to regulate the production of those chemicals, a uniform EU approach will be key to ensuring harmonisation and clarity of rules.”

Besides, the major policy plan of the EU Green Deal, includes the aim of a 55 per cent reduction in greenhouse gas emissions by 2030 compared to 1990, something that companies operating in the chemical industry should also respect.

Companies in the EU therefore will face significant challenges in the forthcoming years to restructure their activities in compliance with the EU’s sustainability plan while remaining competitive.

How does CEE rank in terms of the chemical industry?

The production in the EU is led by Western countries, such as Germany and France, accounting for 46 per cent of sales valued at around 274 billion euros, followed by Italy and the Netherlands. In the meanwhile, in CEE, the chemical industry makes also an important contribution to the local economies.

In terms of revenues, Poland ranked in the top 10 States in 2020 just like Turkey and the Czech Republic. In 2021, the chemical industry in Poland employed 335,000 people which accounts for 12 per cent of the total employment in the Polish industry. The sector was the third most important in terms of employment providing jobs to more people than other industries such as automotive, furniture and mining. Based on the report of the Polish Chamber of Chemical Industry, 2019-2021 data demonstrates that the chemical sector is among the fastest growing ones with an annual growth rate of products sold of nearly 5 per cent.

The war in Ukraine has had a major impact also on the chemical industry in Poland. Rising gas and energy prices and the limited availability of some raw materials posed serious challenges for several companies including those in the chemical sector. Moreover, decisions to temporarily restrict the production of materials such as ammonia or nitrogen fertilisers also severely affected other sectors of the industry. According to the statement of the PCC group, the international chemicals, logistics and energy groups that are present also in Poland, despite the changes in the Polish chemical market, could maintain their growing trend.

As in Poland, the chemical industry plays a key role also in the Czech economy and is the second largest manufacturing sector in terms of turnover after the automotive industry. Compared to Poland, the number of people employed in the sector is less significant at around 138,000, but the size of the country is smaller as well. The Czech chemical industry is very diverse, with products including motor fuels, fuel oils, lubricants, paraffin, fertilisers and plastics. Biofuels and biochemical products are playing an increasing role in the economy. Hydrogen is already being produced at an annual rate of more than 100 tonnes, which can pave the way to further progress.

Finally, let’s look a little to the south, to Turkey. The Turkish chemical industry is one the second largest industry in the country, accounting for 14 per cent of its total exports. Based on the report of Strategy&, a consulting business, part of the PwC, in the first quarter of 2022, Turkish chemical exports reached 7.5 billion US dollars (6.84 billion euros), with an annual growth rate of around 40 per cent. In terms of chemical sub-segments, mineral fuels exports have become the fastest-growing segment, increasing their share in Turkey’s total chemical exports from 20 per cent in 2020 to nearly 26 per cent in 2021. The segment of plastics, rubber and inorganic materials presented a year-to-year growth of at least 30 per cent or even more in 2021.

Based on the report, the Ministry of Industry and Technology in Turkey has implemented a Technology-Focused Industry Attempt that provides several incentives for the development and production of 900+ priority products – comprising 281 chemical products – that require advanced technology ad have a major role in the trade balance. Besides, in line with the EU regulations, a Green Deal Action Plan was developed as a roadmap to comply with the agreement.